oklahoma franchise tax instructions

Corporations are taxed 125 for each 1000 of capital invested or otherwise used. Mail your return to.

Oklahoma Tax Commission Oktaxcommission Twitter

Mailing Instructions Please mail your completed return officer information and payment to Oklahoma Tax Commission Franchise Tax PO.

. Handy tips for filling out Oklahoma form 200 online. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax. Oklahoma Tax Commission Franchise Tax Post Office Box 26930 Oklahoma.

To file your Annual Franchise Tax by Mail. On the Oklahoma Tax Commission website go to the Business Forms page. The maximum annual franchise tax is 2000000.

2020 Oklahoma Small Business Corporation Income and Franchise Tax Forms and Instructions. For a corporation that has elected to change its filing period to match its fiscal year the franchise tax is due on the 15th day of the third month following the close of the. The 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma form is 48 pages long and contains.

The rules legislation and. Oklahoma levies a franchise tax on all corporations or associations doing business in the state. Instructions for completing the Form 512 512 corporation.

Paper returns without a 2-D barcode should be mailed to the Oklahoma Tax Commission PO. Mine the amount of franchise tax due. If filing a stand-alone OklahomaAnnual Franchise Tax Return Form 200 do not.

Companies are taxed on their total gross receipts. To make this election file Form 200-F. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

Oklahoma franchise tax is due and payable each year on July 1. Printing and scanning is no longer the best way to manage documents. The Oklahoma Franchise Tax is a state tax levied against companies doing business within the borders of Oklahoma.

Scroll down the page until you find Oklahoma Annual Franchise Tax. Payment made payable to Oklahoma Tax Commission balance sheet and schedules A B C and D. When is franchise tax due.

Late payments of franchise tax 100 of the franchise tax liability must be paid with the extension. Includes Form 512 and Form 512-TI 2012 Oklahoma Corporation Income Tax Forms and Instructions This packet contains. The franchise tax is waived for revenue and assets of less than 200000 and is capped at 20000.

For a corporation that has elected to change its filing period to match its fiscal year the franchise. Go digital and save time with signNow the best solution for. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or.

TaxFormFinder - One Stop Every Tax Form.

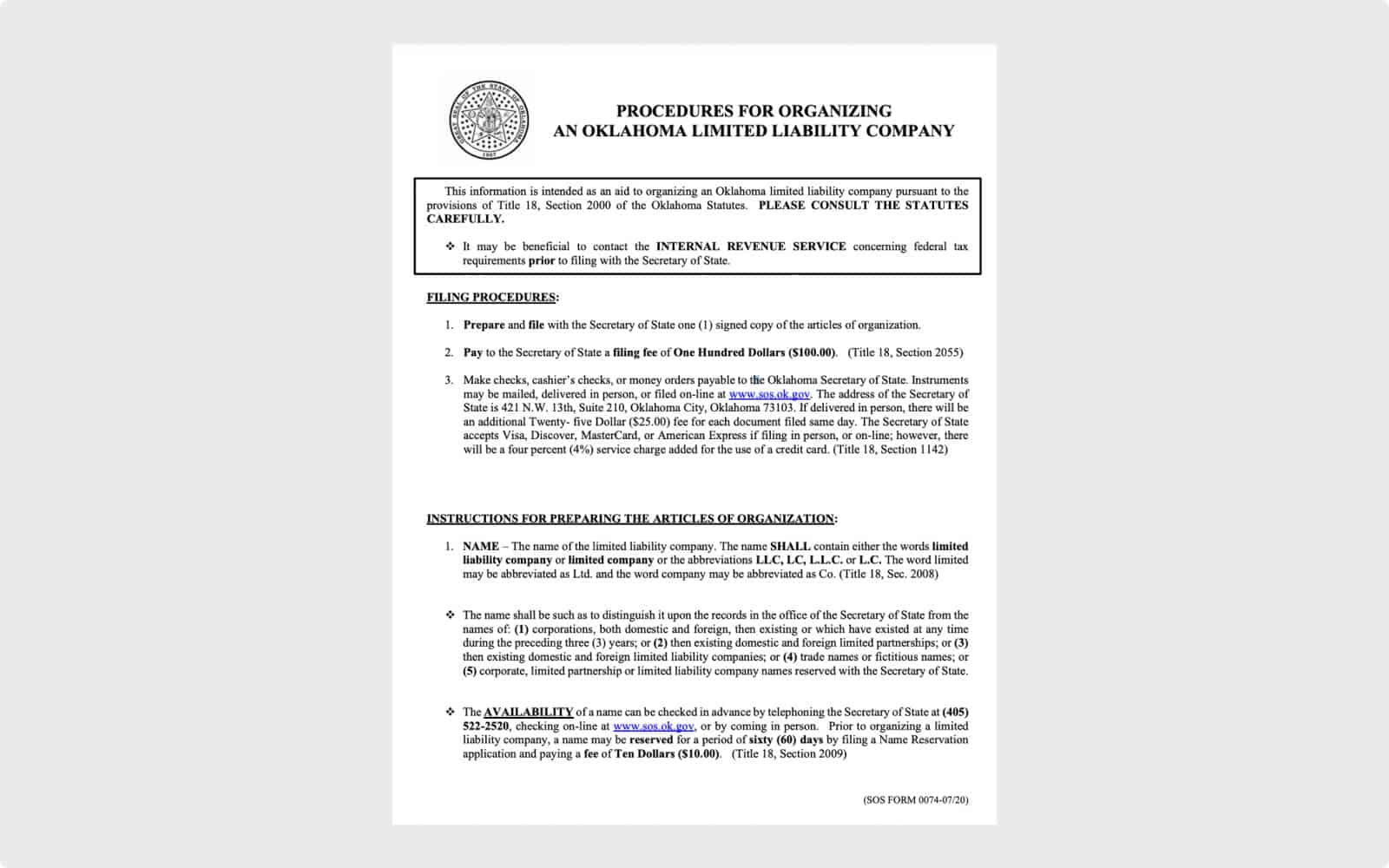

Oklahoma Business Registration Oklahoma Llc Incfast

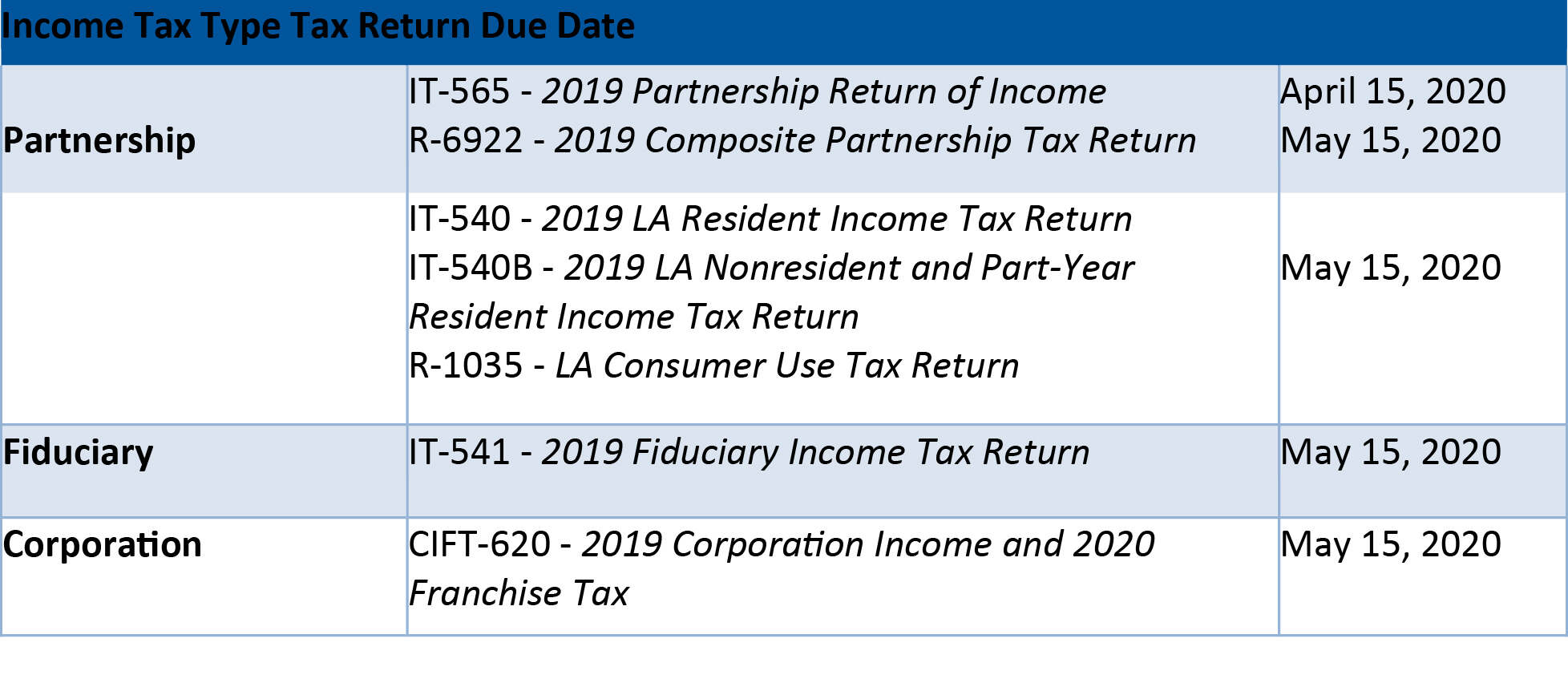

State Income Tax Extensions Weaver

Fill Free Fillable Forms State Of Oklahoma

State Accepts Payment Plan In Stockton Ca 20 20 Tax Resolution

Taxes How Do I File In 2 Different States Orange County Register

Fill Free Fillable Forms State Of Oklahoma

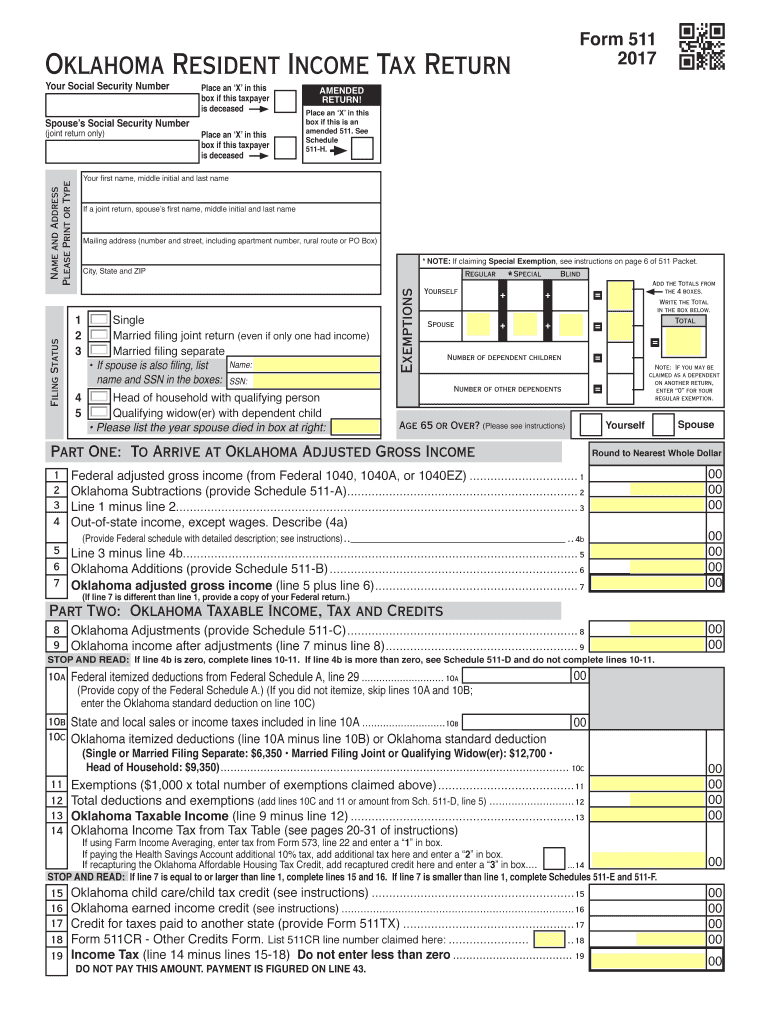

Free Form 511 Oklahoma Resident Income Tax Return And Sales Tax Relief Credit Form Free Legal Forms Laws Com

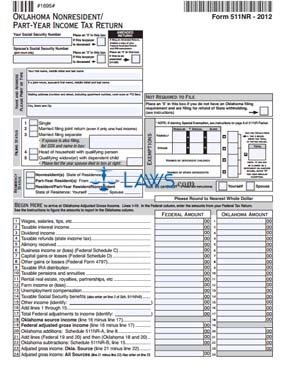

Form 511nr Oklahoma Nonresident Part Year Income Tax Return Youtube

State Income Tax Extensions Weaver

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Complete And E File 2021 2022 Oklahoma Income State Taxes

Where S My State Tax Refund Updated For 2022 Smartasset

Costs Fees To Form And Operate An Llc In Oklahoma Simplifyllc

Oklahoma Tax Commission Irs Grant Relief Due To Severe Winter Storms Mcafee Taft

Oklahoma Resident Tax Form 511 2014 Fill Out Sign Online Dochub

Free Form 511nr Oklahoma Nonresident Part Year Income Tax Return Free Legal Forms Laws Com